COLUMBUS is a long-term simulation model for the global natural gas market. Taking into account worldwide interdependencies, the model predicts possible developments up to the year 2040. In addition to simulations on the annual level, it is also possible to perform calculations on the semi-annual, quarterly or monthly timescale. In doing so, the seasonal fluctuating demand profiles are able to be taken into account. In addition, the model extends the option to display the strategic behavior of some natural gas market participants.

The model takes into account all key natural gas-producing countries and their specific characteristics (e.g., production costs, infrastructure connections, unconventional natural gas reserves). Furthermore, all relevant demand countries are included (approx. 99 percent of global demand). All required data for the model is continuously updated in the EWI database.

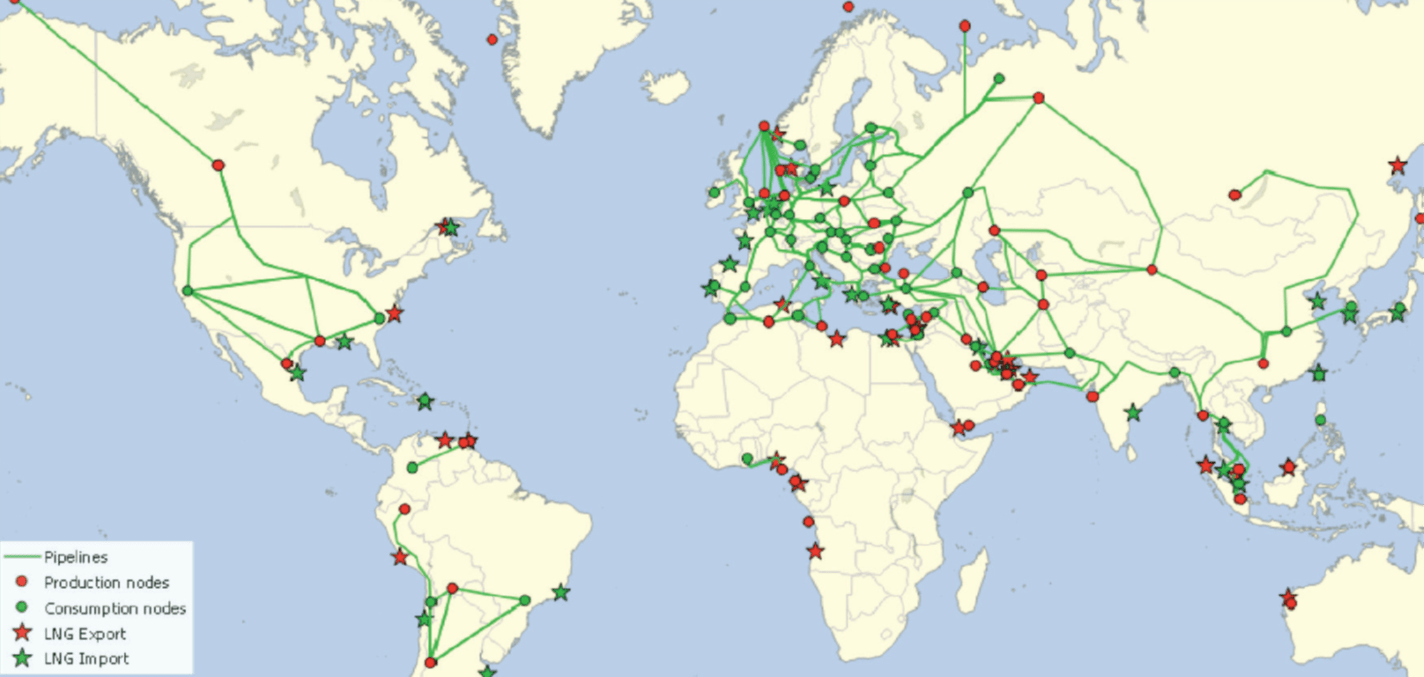

Market coverage of the COLUMBUS model: Production and demand regions, pipeline connections and LNG terminals

Characteristics of the supply side:

Characteristics of the demand side:

COLUMBUS is designed as a dynamic, spatial and intertemporal model. It is based on a mixed complementary programming approach (MCP). The model includes all key natural gas market fundamentals and characteristics, facilitating a comprehensive quantitative analysis of future market developments.

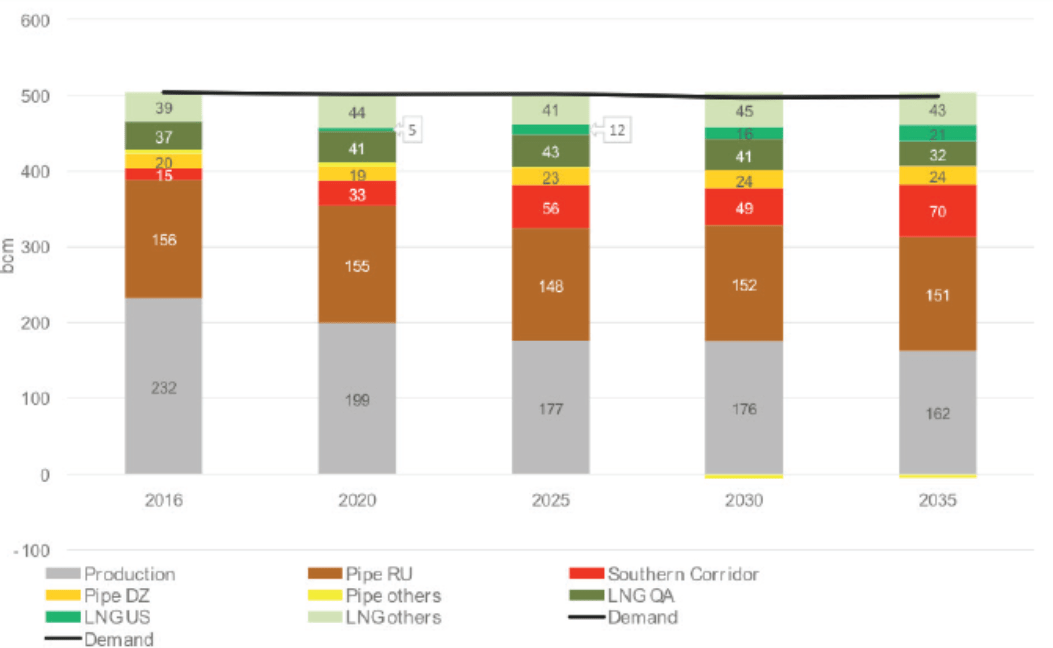

COLUMBUS simulates current and future global natural gas and LNG trade flows.

COLUMBUS determines capacity utilization of natural gas infrastructure such as storage, production facilities, pipelines and LNG terminals (export and import).

COLUMBUS shows the amount and the geographical location of demand for investment in production fields, transport and storage infrastructure.

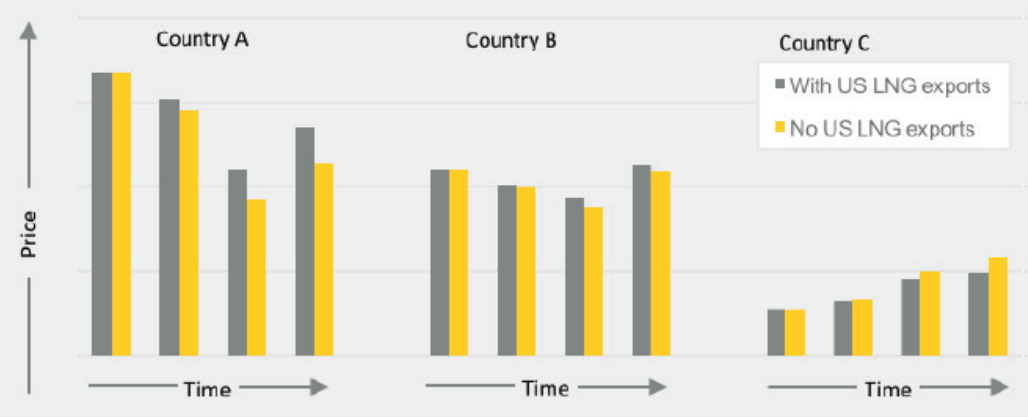

COLUMBUS predicts medium- and long-term price developments (with or without strategic behavior of the different natural gas market participants).