Thanks to savings in industry, households and power plants as well as high LNG imports, European gas storage facilities were almost completely filled at the start of the 2023/2024 heating season. The supply situation for the winter of 2023/2024 has therefore improved significantly compared to last year, partly due to the expansion of the LNG import infrastructure. A possible shortfall in demand has become less likely, but cannot be ruled out due to the simultaneous occurrence of overlapping effects on the supply and demand side. Risks arise in particular from weather conditions, the availability of LNG on the global market and the continuity of gas imports from Russia, which currently still account for around 8 percent of European gas imports.

A team from the Institute of Energy Economics at the University of Cologne (EWI) has analysed the availability and demand for natural gas in the coming winter in the brief analysis ” Gas Supply Outlook in the EU in the gas year 2023/2024″. To this end, four scenarios for the balanced availability and demand for natural gas in the EU and the UK were analysed, each for two demand and supply situations. On the demand side, a continuation of the current demand trend, i.e. a drop in consumption of around 15 percent compared to the multi-year average from 2017 to 2022, is contrasted with a cold winter and the resulting increase in demand. On the supply side, the availability of Russian imports as LNG or via pipeline at the current level of around 8 percent is compared with a discontinuation of import volumes.

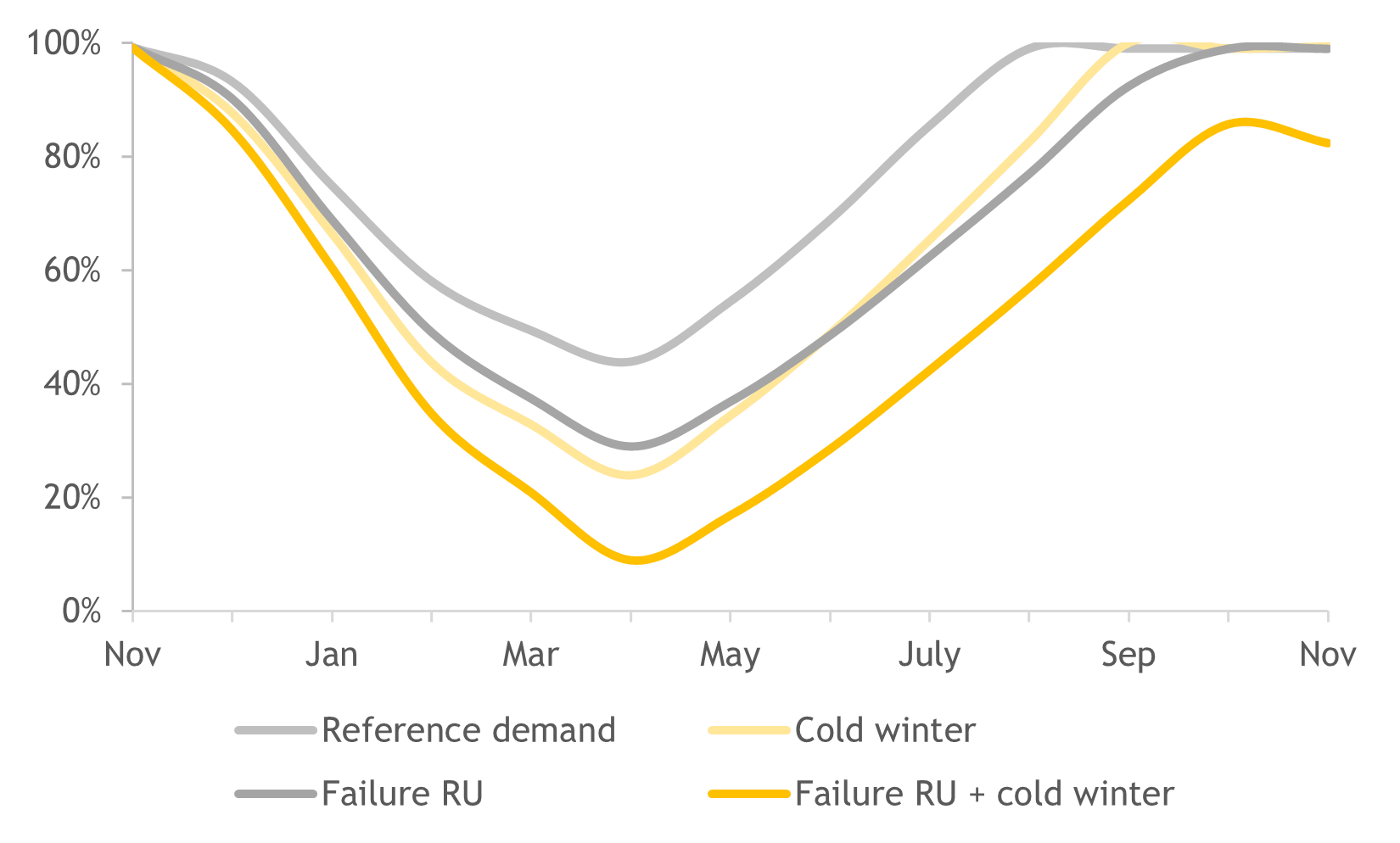

In three of the four scenarios, the assumed gas demand can be met at any time within the assumptions made and the storage facilities can be refilled to at least the prescribed 90 percent by October 2024. The gas storage facilities could be filled to between 24 and 44 percent at the end of the winter. A critical situation could therefore arise in the event of a cold winter without imports of Russian natural gas. In this scenario, the European gas storage facilities would be almost completely empty and may not be able to be refilled to the gas storage target of 90 percent for the following winter of 2024/2025.

The analysis looks at gas demand and volumes in the EU (including the UK and excluding Spain and Portugal). For LNG imports, the analysis assumes a high utilisation of the LNG import infrastructure of up to 90 percent. However, due to the change in the gas import structure and the stronger focus on LNG, Europe is significantly more dependent on the global availability of LNG. This means, for example, that the development of gas demand in East Asian countries or the export situation in regions such as Egypt and the neighbouring Middle East can have an impact on the European gas markets.

The balance sheet analysis quantifies volume effects, but not price effects. A high utilisation of the European LNG import terminals, as assumed in the analysis, presupposes a corresponding willingness to pay for LNG. “A shortage of gas supply on the global market is currently repeatedly leading to strong reactions in European gas prices,” says David Schlund, Senior Research Consultant at the EMI, who prepared the analysis with Hendrik Diers and Michaele Diehl. “In situations with high LNG demand and reduced supply, we could therefore see higher prices again and again in the short term in the coming months. The situation on the global gas market could ease from around 2026, as the EWI showed in an earlier analysis this year.”